|

vol.

82, no. 4

Boom and Bust Follow an Old Austrian Script by Roger W. Garrison

Austrian-born Friedrich A. Hayek lectured and wrote in the early 1930s on unsustainable booms. In 1974 he was awarded the Nobel Prize in large part for masterminding the "Austrian" theory of the business cycle. The Austrian theory is set apart from others by its emphasis on the role of interest rates in the context of time-consuming production processes. In modern industrial economies, production time, as measured from sizing the plant to satisfying the consumer, is substantial. Costs come before revenues-and sometimes well before. Private (and corporate) saving sees the production plans through to completion. The profitability and even the survivability of time-consuming ventures can depend critically on the particulars of the timing. If the timing is off in one direction or the other, profits are diminished. Firms incurring actual losses might have to contract or even file for bankruptcy. For the economy as a whole, the relevant time dimension is much more complex because the output of one industry (e.g. steel) sells as inputs to others (e.g. automobiles). But what if the timing is off on an economywide basis? What if business planning in general is systematically biased in favor of relatively large up-front costs and relatively distant revenues? This unfortunate bias will play itself out, according to the Austrian theory, as boom and bust. In a market economy, interest rates keep the timing of production activities in line with consumer preferences. If people are willing to save more, businesses are given time to expand their production capacities. Resources not currently consumed are freed up for the purpose. The increased saving translates into lower interest rates and lower cost of capital generally. The business community has both the incentive and the finances to bridge a larger time gap between production and consumption. The key to avoiding booms and busts, then, is letting the interest rate tell the truth about time. But with a central bank dominating the economic landscape, truth can get distorted. And with continued pro-active management of credit conditions, the truth can fall into total eclipse. The Austrian theory suggests that Fed-controlled interest rates during the late 1990s were generally too low. The financing of business activity was facilitated by real saving augmented by the credit creation of an accommodating Federal Reserve. Compounding the problem, the low interest rates caused would-be savers to save less and to consume instead. For this double-barreled reason, long-term business plans were at odds with consumer preferences. With increased credit and reduced saving, the business community was scripted to bridge an unbridgeable time gap. Failure on an economywide basis, i.e., a downturn, was the inevitable consequence. In accordance with the theory, the downturn is most pronounced in the traditional investment sector-but, more pointedly, in any business that must survive for a long period on external financing while waiting for net revenues to turn positive. Many a dot.com, for instance, adopted a strategy of building a market over a period of years before positive net revenues could become a reality. The theory also suggests that the downturn affects consumer-oriented businesses (e.g. K-Mart) only after the contraction in the investment sector leads to a fall in consumer incomes. What could have led the Federal Reserve to think or hope the boom was sustainable? For one thing, with the Federal Reserve committed to maintaining credit conditions consistent with the rapid expansion, there was no observable truth-telling rate of interest with which the Fed-influenced rates could be compared. For another, real increases in productivity (the digital revolution, widespread use of the internet, and just-in-time inventory management) allowed for continuing credit expansion without the bloated monetary aggregates (M2, M3, and MZM) putting upward pressure on prices and wages. In retrospect, the theory that productivity gains had given rise to a sustainable boom turns out not to be an alternative theory at all. Rather, it is a supporting sub-theme in the Austrian account of boom and bust. Productivity had increased during the 1990s, just as it had during the 1920s. In both periods, this circumstance allowed the credit expansion to proceed apace without triggering inflation and hence warning that Fed policy was too loose. The record low unemployment rate of 3.9 percent in late 2000, which could have served as a warning, was taken instead to be a productivity-enhanced sustainable rate, the hallmark of the "New Economy." With inflation in check and low unemployment rationalized as sustainable, there was no way to know that the economy was experiencing a bubble until the bubble burst. This point, made repeatedly by Alan Greenspan, is but a corollary to our contention that with a pro-active Fed in play, there is no way to know what interest rates ought to be. But now that the bubble has burst, we can chalk it all up as still another application of the Austrian theory of the business cycle.

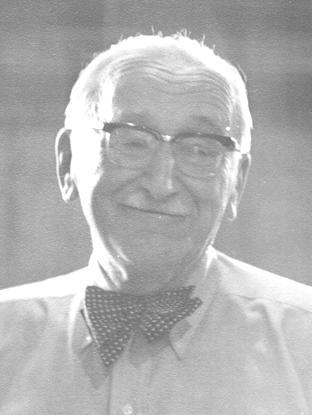

Roger W. Garrison, a professor of economics at Auburn University, is the author of Time and Money: The Macroeconomics of Capital Structure (Routledge, 2001), E-mail: garriro@auburn.edu |

The downturn

that began officially last March was almost surely in the making several

Marches earlier. Both the boom and the bust have followed a script written

some 70 years ago.

The downturn

that began officially last March was almost surely in the making several

Marches earlier. Both the boom and the bust have followed a script written

some 70 years ago.