MACROCAT INTERMEDIATE

MACROECONOMICS

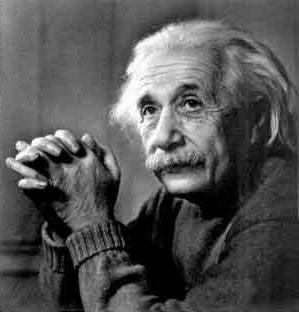

Purpose and Scope of the Course: Guided by the text and the materials available through the course website, the lectures will develop the analytical tools needed to deal with such issues as unemployment, inflation, business cycles, and economic growth. An effort will be made to strike a balance between acquiring technical skills and achieving economic understanding. After completing the course, students should have a solid grasp of the several competing macroeconomic frameworks and of the nature and causes of the current macroeconomic malaise. They should be able to identify the many fallacies in the following passage, which inspird by John Maynard Keynes but was actually penned (in 1934) by Albert Einstein:

Synopsis

and Stocktaking: The course

begins

with the ideas that existed prior to the publication of John Maynard

Keynes's General Theory of Employment, Interest, and Money

(1936)

and traces the macroeconomics that has evolved out of the Keynesian

Revolution. Synopsis

and Stocktaking: The course

begins

with the ideas that existed prior to the publication of John Maynard

Keynes's General Theory of Employment, Interest, and Money

(1936)

and traces the macroeconomics that has evolved out of the Keynesian

Revolution. Classical economics, which dates from Adam Smith's Wealth of Nations (1776), reflects the summary judgment that markets work and that market-economies grow–implying a policy recommendation of laissez faire. It is this judgment that Keynes called into question and that lies at the root of modern debate. Is there a market mechanism that coordinates economic activities over time? More pointedly, does saving today get translated into investment for the future? The Austrian economists, particularly F. A. Hayek, focused attention on the rate of interest and showed how intertemporal coordination is (or, at least, can possibly be) achieved in a market economy. Keynes rejected the classical and Austrian views and made the summary judgment that the saving-cum-investment nexus of the market economy is failure-prone. The perceived absence of vital market mechanisms caused him to recommend policy activism as an alternative means of securing full employment.   The simplest Keynesian model (Y = C + I + G)* ignores both

interest-rate

and price-level considerations; the extended models (ISLM** and

AggS/AggD***)

incorporate interest-rate effects (ISLM) and both interest-rate and

price-level

effects (AggS/AggD). All the Keynesian constructions reflect the notion

that

some markets (for goods, for labor, and/or for loanable funds) fail to

work––or work

perversely or work

too sluggishly––to maintain full employment.

The simplest Keynesian model (Y = C + I + G)* ignores both

interest-rate

and price-level considerations; the extended models (ISLM** and

AggS/AggD***)

incorporate interest-rate effects (ISLM) and both interest-rate and

price-level

effects (AggS/AggD). All the Keynesian constructions reflect the notion

that

some markets (for goods, for labor, and/or for loanable funds) fail to

work––or work

perversely or work

too sluggishly––to maintain full employment. A quarter of a century after the publication of Keynes's General Theory, a trumped-up classical model was introduced into macroeconomic textbooks. This model, which no know classical economist ever endorsed, either ignores the saving-cum-investment coordination mechanism or fails to integrate that mechanism into the classical framework. But the relevance and plausibility of this model rests on the implicit assumption that the market has no problem in translating saving into investment.  In addition to

Keynesianism,

Austrianism, and Classicism, other schools of thought––Monetarism

(Milton

Friedman),

In addition to

Keynesianism,

Austrianism, and Classicism, other schools of thought––Monetarism

(Milton

Friedman), New Classicism (Robert Lucas), Real Business Cycle Theory (Edward Prescott) and New Keynesianism (Gregory Mankiw)––will be considered. By the end of the term, the student should have a good understanding of the core of ideas that unite the various schools of thought as well as the major issues that separate them.

**In ISLM analysis, equilibrium is achieved when Investment (I) equals Saving (S) and the Demand for Money (L) equals the Supply of Money (M). ***In AggS/AggD analysis, equilibrium is achieved when Aggregate Supply equals Aggregate Demand, where AggS and AggD are each conceived as a relationship between income (Y) and the price level (P). The logical integrety of this construction is threatened by tha fact that the two P-Y relationships (underlying AggD and AggS) are based on different–and conflicting–assumptions about the way a market economy functions. Class Participation: Student participation is encouraged and welcomed. Questions for the purpose of clarification will benefit most all the students; critical questions and comments tend to make the course more interesting. Organization, Readings, and Exam

Schedule:

The reading material is divided into three lecture series as shown in

the

table below. The table includes reading assignments from Richard T.

Froyen's Macroeconomics: Theories and Policies, 9th edition, as

well as readings available through this site. The

scheduling of the textbook chapters may be modified as the course

progresses. Also, additional readings may be assigned as appropriate.

The subject matter covered in class will parallel the assigned reading, but in some instances the lectures will go beyond the text. Thus, the text and the lectures should be viewed as complements and not as substitutes. The analytics of macroeconomic phenomena will be the primary focus of the lectures. The Handouts, Readings, PowerPoint files, and Links available through this web site should be helpful. The Handouts summerize some of the key concepts discussed in class and give the students a preview of test material. The Readings reinforce and elaborate upon the ideas presented in the text. The PowerPoint files are the ones shown in class and are made available here for reinforcement and review. The Links are intended to anchor class material to some of the institutions, policy actions, and macroeconomic data being discussed. Examinations: There will be two one-hour exams (scheduled for September 29 and October 27) and a comprehensive final exam as scheduled by the university (December 8, 12:00 - 2:30 p.m.). The exams will be constructed in a multiple-choice format but some questions will require a graphical and/or algebraic solution. The wearing of caps, hats, bonnets, sombreros, motorcycle helmets, ski masks or other headgear is not allowed during the exam. Grading System: One-fourth

of your course grade is based on

attendance. Each student begins the course with 100 attendance points.

Then, beginning on Monday, August 23, he or she will lose three points

for

each

unexcused absence. Late-arriving students can be counted as absent at

the discretion of the professor. The three exams will count 100 points

each, which means that the total possible points in the course (exams

plus attendance) is 400.

Hence, if a student has four

unexcused absences (for an attendance score of 88) and has exam scores

of 76, 85, and 79, his or her course average would be (88 + 76 + 85 +

79)/4 =

83. Letter

grades for the course will be determined by applying a 10-point scale

to

the course average. That is, 90 and above is an A; 80 to 90 is a

B; etc. Make-ups: Students will not be permitted to take the exams early or late. Should it become necessary for a student to miss an exam, he or she should notify the instructor in advance of the exam date. Students with excused absences will be required to take a make-up exam as arranged by the professor. Supplemental Materials:

Advanced Reading--optional Roger W.

Garrison, Time

and

Money: The Macroeconomics of Capital Structure, London:

Routledge,

2001

|

Only

a fraction of the available human labor in the world is now needed for

the production of the total amount of consumption goods necessary to

life.

Under a complete laissez-faire economic system, this fact is bound to

lead

to unemployment. ... This leads to a fall in sales and profits.

Businesses

go bust, which further increases unemployment and diminishes confidence

in industrial concerns and therewith public participation in the

mediating

banks; finally the banks become insolvent through the sudden withdrawal

of accounts and the wheels of industry therewith come to a complete

standstill....

If we could manage to prevent the purchasing power of the masses,

measured

in terms of goods, from sinking below a certain minimum, stoppages in

the

industrial cycle such as we are experiencing today [1934] would be

rendered

impossible. The logically simplest but most daring method of achieving

this is a completely planned economy, in which consumption goods are

produced

and distributed by the community.

Only

a fraction of the available human labor in the world is now needed for

the production of the total amount of consumption goods necessary to

life.

Under a complete laissez-faire economic system, this fact is bound to

lead

to unemployment. ... This leads to a fall in sales and profits.

Businesses

go bust, which further increases unemployment and diminishes confidence

in industrial concerns and therewith public participation in the

mediating

banks; finally the banks become insolvent through the sudden withdrawal

of accounts and the wheels of industry therewith come to a complete

standstill....

If we could manage to prevent the purchasing power of the masses,

measured

in terms of goods, from sinking below a certain minimum, stoppages in

the

industrial cycle such as we are experiencing today [1934] would be

rendered

impossible. The logically simplest but most daring method of achieving

this is a completely planned economy, in which consumption goods are

produced

and distributed by the community.